Early vs Late Portfolio Prioritization – Best Practices

- Magnus Ytterstad

- Sep 30, 2022

- 3 min read

Prioritizing projects in a portfolio based on risk-adjusted value metrics such as expected NPV, PYS, and ROI will always favor projects late in the development pipeline due to the impact of PTRS (probability of technical and regulatory success). Late projects naturally have a higher value since they are de-risked to a greater extent than early projects. But it is sometimes valuable to look at and prioritize projects with less focus on PTRS and more focus on other value drivers.

Here are a few suggested methods for project evaluations that will give different perspectives on project priority than what is usually done. In some cases, the methods are suitable for discovery projects where there is little or no commercial information available

Group Projects Based on Level of Risk

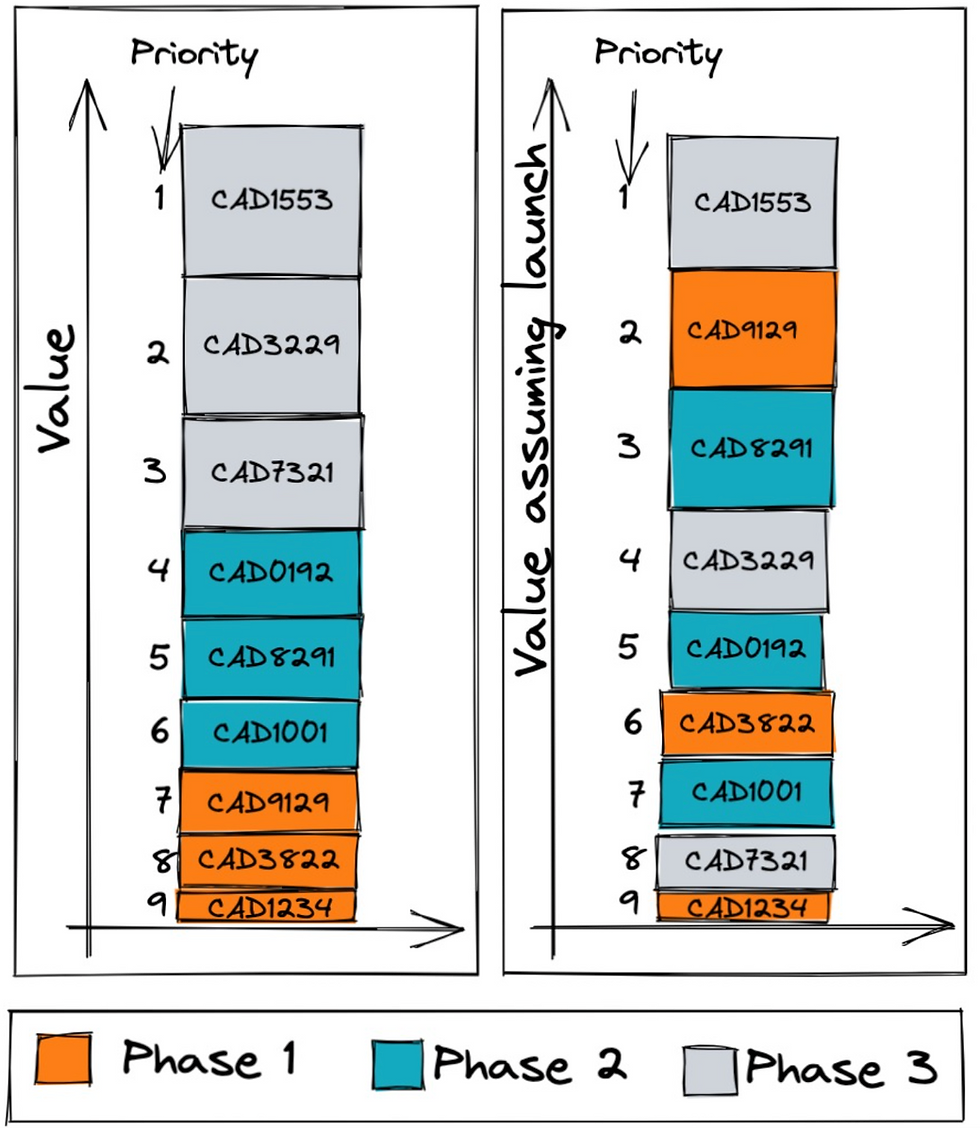

If we focus on value and PTRS for the entirety of the portfolio, only late-stage projects will get prioritized (see left box). We will have a similar result if we group projects by TA (see top right box).

On the other hand, if we group projects based on which phase of development they are in, or by time to launch, we can compare the merits and flaws of projects with similar risk profiles and time to market (see bottom right box).

Risk-adjusted vs Value Assuming Launch

PTRS is the single most important factor that affects project value, and therefore it plays a significant part in all eNPV or eROI calculations. However, it also overshadows all other risks and value drivers.

Because of this, it can be insightful to look at the composition of project value assuming launch, i.e., taking PTRS out of the picture. The right-hand chart gives us a different perspective on value compared to the risk-adjusted value metrics on the left.

Portfolio Sustainability Over Time

Focus on portfolio sustainability will bring out the importance of different parts of the portfolio. Pharmaceutical products have a life span of +20 years from inception to patent expiry, and it is healthy to have the same focus when looking at the portfolio. The late portfolio will run its course in 8-12 years and will become less important in the later years. In 10 years, the portfolio revenue targets will be met largely by what is currently in the early portfolio.

For discussions about meeting revenue targets in 10 years, it is important to isolate the early portfolio and focus analysis on how those projects, plus business development, will meet revenue targets.

Variability of Value Potential

Instead of just looking at risk-adjusted values such as eNPV and eROI (shown in the top box chart), it is insightful to also look at the full variability of the value proposition. Extreme values will usually not come out when assessing expected values only.

However, when looking at the 5th and 95th percentiles, we may gain valuable insights about project potential and unacceptable risk. Looking at these percentiles will negate some of the over-shadowing effects of PTRS on value and risk metrics.

Qualitative Assessments - MADA

Multi-Attribute Decision Analysis (MADA) is another way of showing the relative merit of projects. Many companies employ MADA as a method to qualitatively assess projects where little or no real quantitative knowledge is available. MADA comes in many flavors, one frequently used variant is to define categories, and then score each project from 1 to 5 on how well they fulfill the criteria for each category. The scores can be added together to create an overall score or ranking of projects. The scoring can also potentially inform quantitative assumptions such as cost, timelines, revenue, and risk. Some companies have early project templates based on how they score in the MADA categories.

Comments